3 Tips to Boost Your Win Rate in Trading.

In trading, improving your win rate is a top priority. Here are three essential tips to elevate your performance and grow as a trader:

1. Align Your Trades with Higher Timeframes

Many traders get caught up in the noise of lower timeframes, losing sight of the bigger picture. By aligning your trades with higher time frames, such as the daily or weekly charts, you gain a clearer perspective of market trends. This approach allows you to trade in the direction of the broader market, reducing the influence of short-term volatility.

How This Helps:

- Enhanced Decision-Making: Higher timeframes eliminate market noise, making it easier to identify strong trends and patterns.

- Improved Confidence: Trading in alignment with the overall market direction increases your confidence in holding positions.

- More Reliable Trades: Focusing on higher timeframes encourages patience and results in fewer but higher-quality trades, improving consistency.

2. Review and Refine Your Past Trading Results

Regularly reviewing your past trading results is a vital habit. Analyse a meaningful sample size of at least 100 trades to identify patterns, strategies, and setups that have worked well. This process allows you to pinpoint your strengths and areas needing improvement.

How This Helps:

- Focus on What Works: By identifying successful strategies and scenarios, you can replicate and scale your most effective approaches.

- Eliminate Ineffective Methods: Discarding what doesn’t work reduces errors and wasted effort.

Continual Improvement: Iterative refinement of your strategy leads to better results and an optimized trading approach.

3. Experiment with Adjusting Stop Losses

Stop losses protect you from significant losses, but overly tight ones can lead to premature exits due to minor price fluctuations. Experimenting with slightly wider stop losses provides the market with the wiggle room necessary to account for natural volatility.

How This Helps:

- Avoid Premature Exits: Wider stops prevent you from being stopped out by small, temporary market movements.

- Maximize Trade Potential: Allowing trades more room to develop increases the chances of reaching profit targets.

- Stress Reduction: Knowing your stop losses account for market fluctuations allows you to trade with greater peace of mind.

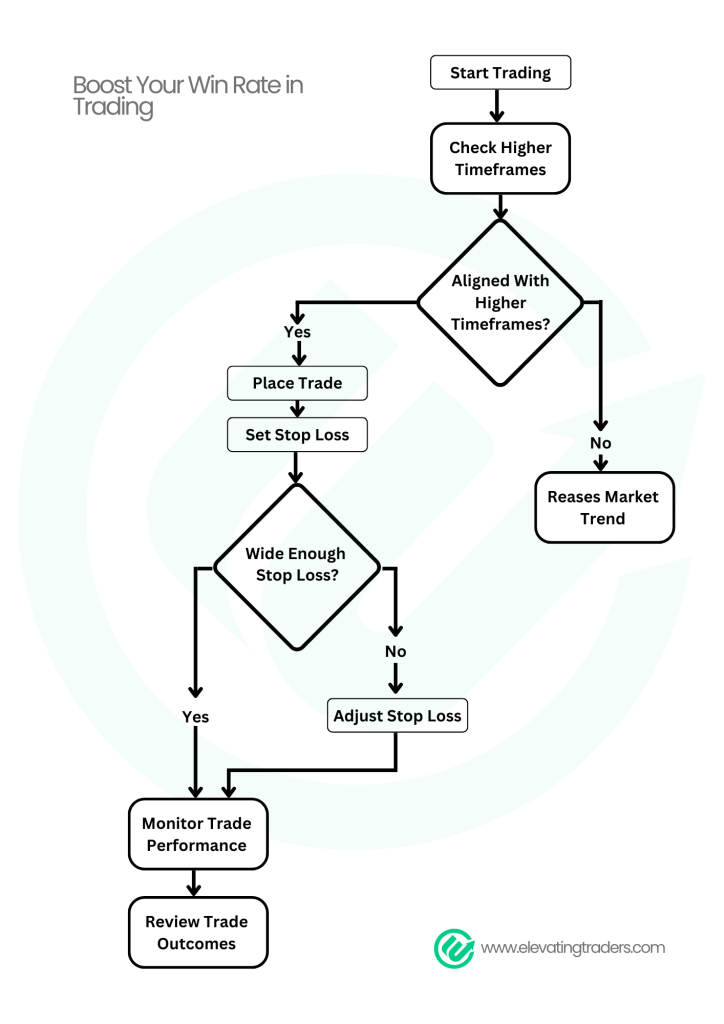

This flowchart guides you through aligning trades with higher time frames, setting and adjusting stop losses, and monitoring performance for continuous improvement.

3 Tips to Boost Your Win Rate in Trading

For more valuable insights across various topics, explore our articles in the Trader Insights Hub.