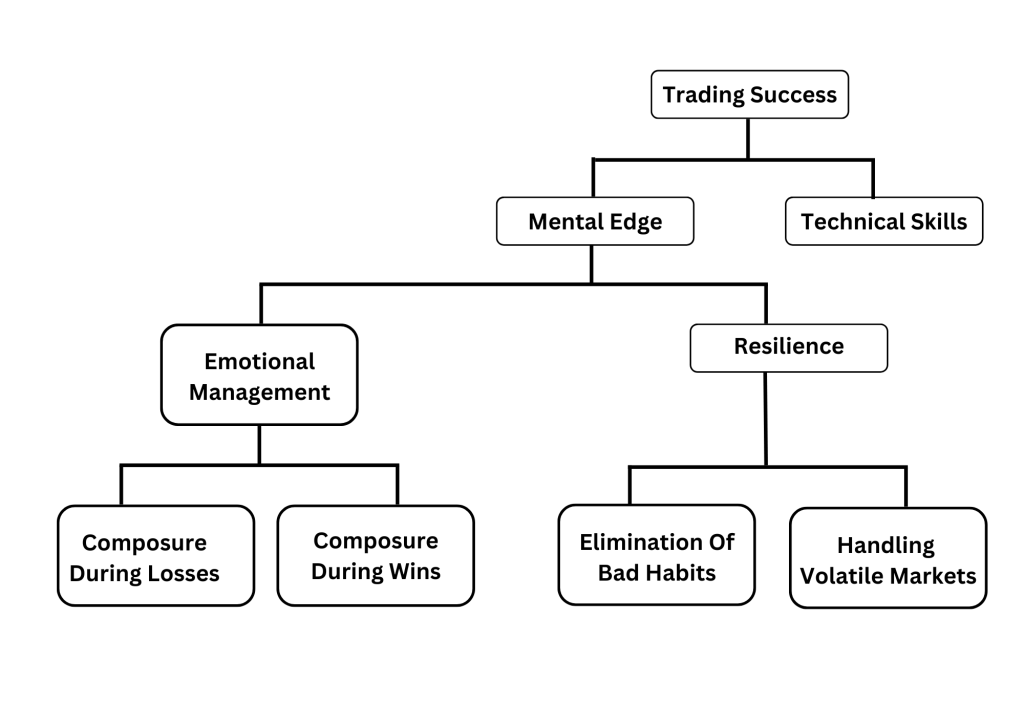

Building a Mental Edge in Trading.

In the world of trading, technical skills are often the main focus. However, an overlooked but equally vital component is the mental edge. This refers to the psychological discipline and emotional management required to perform consistently in the markets. Without it, even the most effective strategies can falter.

Why Mental Edge Matters

Many traders spend countless hours perfecting their strategies and analysing charts, but they neglect the crucial element of mental preparedness. Here’s why the mental edge is indispensable:

- Emotional Management: Trading inevitably involves ups and downs. The ability to remain composed during wins, losses, and volatile market conditions separates successful traders from the rest.

- Amplified Results: A trader with a strong mental edge can take the same strategy as someone else and achieve exponentially better results due to superior emotional control.

Avoiding Self-Sabotage: Even the best trading edges can be undermined by emotional mistakes. Fear, greed, and frustration can lead to irrational decisions, erasing gains and compounding losses.

How to Build a Mental Edge

Developing a mental edge requires deliberate effort and consistent practice. Here are actionable steps to get started:

- Set Emotional Rules: Establish clear guidelines for how you will react to wins, losses, and market volatility. For example, limit the number of trades per day to prevent overtrading.

- Practice Self-Awareness: Monitor your emotions while trading. Use a journal to record your thoughts and feelings after each session.

- Use Visualisation Techniques: Mentally rehearse scenarios where you might feel pressure and visualize yourself responding calmly and rationally.

- Develop Resilience: Accept losses as part of the trading process. Focus on long-term performance rather than individual outcomes.

- Eliminate Bad Habits: Identify habits that harm your trading performance, such as revenge trading or overleveraging, and replace them with positive practices.

The Role of Habits in Trading

Habits play a significant role in shaping a trader’s mental edge. Good habits, such as maintaining discipline and sticking to a trading plan, enhance performance. Conversely, bad habits can erode confidence and lead to poor decision-making.

Conclusion

The mental edge is the cornerstone of long-term trading success. While technical skills and strategies are important, emotional management and mental discipline often make the ultimate difference. By dedicating time and effort to building your mental edge, you position yourself to thrive in the competitive world of trading.

Build Mental Edge

For more valuable insights across various topics, explore our articles in the Trader Insights Hub.