Difference Between Swing & Day Trading.

When it comes to trading in financial markets, two of the most common styles are swing trading and day trading. Both approaches have their own set of advantages and challenges, and choosing the right one depends on your lifestyle, risk tolerance, and trading goals. In this article, we’ll explore the key differences between swing trading and day trading.

What is Swing Trading?

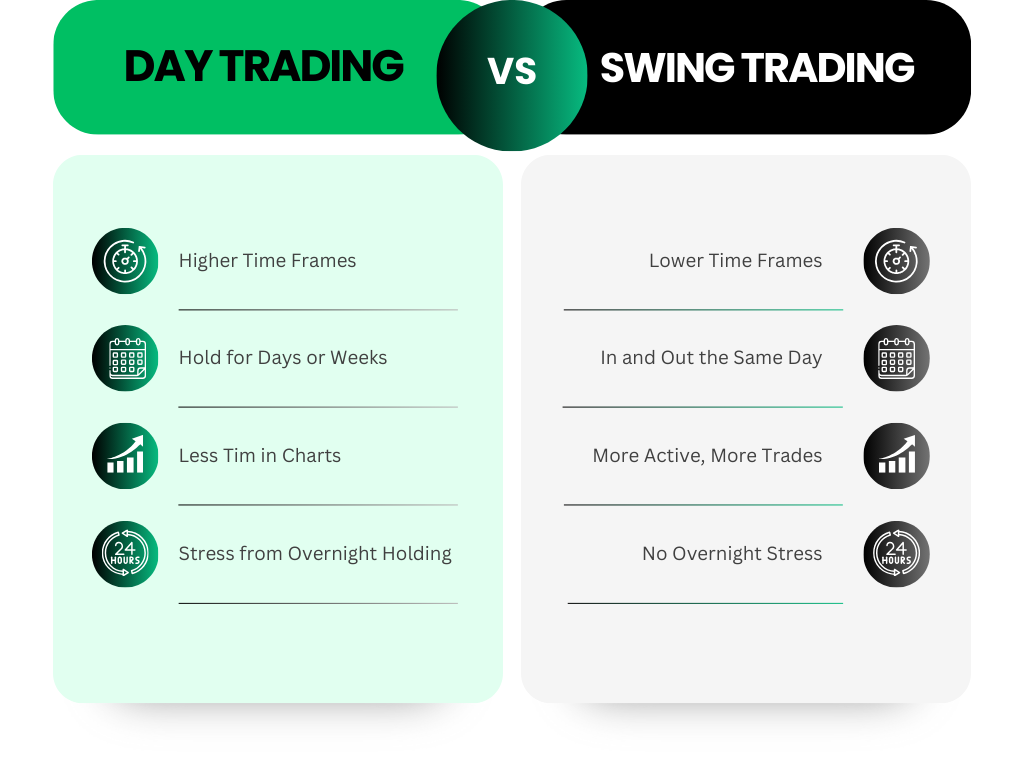

Swing trading involves holding positions over a period of several days to weeks, and in some cases, even months. This method focuses on capturing larger price movements over time, and traders typically use higher timeframes such as the daily or weekly charts.

Key Characteristics of Swing Trading:

- Higher Time Frames: Swing traders analyse charts using daily or weekly time frames to identify trends.

- Holding Period: Swing trades last several days or weeks, allowing traders to capitalize on larger price moves.

- Fewer Trades: Swing traders might execute one or two trades per week or less, giving them time for analysis and strategy development.

- Less Active Management: Since positions are held for longer, swing traders spend less time actively monitoring the markets compared to day traders.

- Drawbacks: One of the main challenges with swing trading is the risk associated with holding positions overnight or over the weekend, which can lead to gaps and unexpected price movements while the trader is not actively monitoring.

What is Day Trading?

Key Characteristics of Day Trading:

- Lower Time Frames: Day traders use smaller time frames like the 1-minute, 5-minute, or 15-minute charts to make quick decisions.

- Quick In and Out: Positions are opened and closed within the same day, typically lasting minutes or hours.

- More Active: Day traders often execute multiple trades per day, requiring them to stay focused and alert throughout the trading session.

- No Overnight Risk: By closing all positions before the market closes, day traders avoid the risk of price gaps that could happen while the market is closed.

- Drawbacks: Day trading requires a high level of time commitment, focus, and stress, as it involves making quick decisions throughout the day.

Choosing Between Swing Trading and Day Trading

Your choice between swing trading and day trading should be based on your availability, risk tolerance, and personality. If you have limited time or are not comfortable managing multiple trades in a fast-paced environment, swing trading might be a better option for you. If you enjoy being active in the market and can dedicate more time to trading, day trading could be the right fit.

Final Thoughts

Both swing trading and day trading offer unique advantages and challenges. Swing trading allows for a more relaxed approach with less frequent trades but comes with overnight risk. Day trading is more fast-paced and requires active engagement but eliminates overnight exposure. The best approach for you depends on your individual preferences, time availability, and trading goals.

Make sure to research both approaches thoroughly before deciding which fits your lifestyle and trading strategy best.