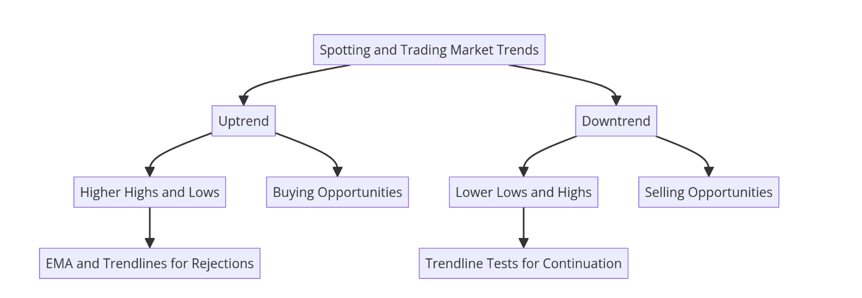

How to Spot and Trade Market Trends.

Identifying and trading market trends is essential for any successful trader. Whether you are new to trading or experienced, understanding the difference between uptrends and downtrends can help you make more informed decisions in the market. In this article, we will explore how to spot market trends and how to trade them effectively.

What is a Market Trend?

A market trend refers to the general direction in which the market is moving. Trends can be either upward (bullish) or downward (bearish). Spotting these trends allows traders to make decisions about whether to buy or sell.

- Uptrend: In an uptrend, prices are making higher highs and higher lows, which indicates that the market is rising.

- Downtrend: In a downtrend, prices are making lower lows and lower highs, which means the market is declining.

How to Spot Market Trends

The most important factor in identifying a market trend is observing the swing points in price action. These swing points represent the highs and lows created by the market over time.

- Uptrend: In an uptrend, traders should look for a series of higher highs and higher lows. These indicate that the market is pushing upward, creating opportunities to buy during pullbacks.

- Downtrend: In a downtrend, traders should watch for lower lows and lower highs. This pattern signals that the market is trending down, offering selling opportunities when the price retraces.

Tools to Aid in Identifying Trends

To help spot trends and trade them effectively, traders can use the following tools:

- Exponential Moving Averages (EMA): The EMA provides dynamic support and resistance levels. In an uptrend, the price often bounces off the EMA, offering buying opportunities. In a downtrend, the EMA can act as resistance, presenting selling opportunities.

- Trendlines: Drawing trendlines by connecting higher lows in an uptrend or lower highs in a downtrend can help traders spot key areas where the trend is likely to continue.

Final Thoughts

Understanding how to spot and trade market trends is a foundational skill for any trader. By observing the swing points, using EMAs and trendlines, and identifying key levels of support and resistance, traders can improve their ability to trade with the trend and increase their chances of success. Make sure to practice these techniques in your own chart analysis and combine them with other technical indicators for a more robust trading strategy.